Microgrids are on the verge of an expansion that extends their use to a broader range of uses and end users worldwide. At this early stage of market evolution microgrid deployments are most numerous and growing fastest at remote sites and locations that for one reason or another lack access to grid power.

Providing reliable, resilient and affordable clean energy access to remote communities and commercial operations around the world represents a sizable, sustainable market opportunity for industry participants.

Similarly, Navigant sees high growth and substantial, sustainable potential in the market for small-scale ¨nanogrids,¨ the market research provider highlights in its 4Q 2015 ¨Market Data: Remote Microgrids and Nanogrids¨ report.

Remote Microgrid Market Prospects

Navigant estimates the overall value of the market for remote power systems to be in excess of $10.9 billion today. The market research company’s analysts forecast this will rise nearly 20-fold over the next decade to $196.5 billion.

Microgid project developers and suppliers and their customers will need to overcome a number of challenges if any such forecast is to be realized, however.

High on this list, Navigant cites existing subsidies for traditional fossil fuel-fired alternatives, logistics and construction issues, and doing business in locations where corruption and shady business practices have historically been all too common.

More broadly, Navigant projects worldwide microgrid vendor revenue will increase from $4.3 billion in 2013 to nearly $20 billion in 2020. According to Navigant: ¨This represents a profound transformation that will affect companies across the power sector.

¨The drivers for this growth are as diverse as the regions in which it’s occurring,¨ the market research company elaborates. ¨In the United States, resilience is the key driver in the Northeast, while the integration of renewable energy resources is driving the spread of microgrids in the West.

Growth prospects for remote, off-grid microgrid deployments will cluster in and around remote sites and locations with limited power transmission and distribution (T&D) infrastructure – northern Canada, for example.

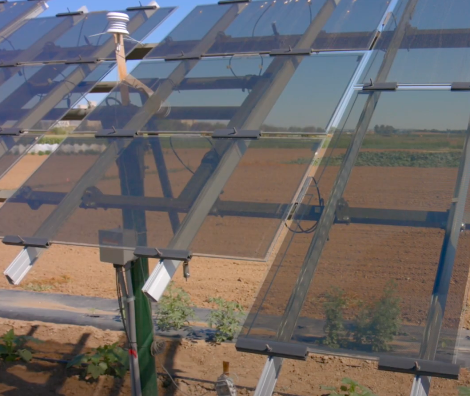

That stands to reason, commented Navigant principal research analyst and report author Peter Asmus told Microgrid Media. The sharply falling cost of solar and wind power generation are fueling growing use of renewable energy at remote, off-grid sites and locations.

Remote, off-grid microgrid deployment ¨is the largest market segment today because the economics make the most sense,¨ he continued. ¨That’s particularly the case in island communities, as well as others isolated from power grids and diesel fuel supply lines, such as communities in polar regions or deep in continental interiors, he added.

¨The ideal scenario is to make use of solar and wind energy. They’re complementary – providing power day and night – which reduces the need for large battery storage capacity.¨ Asmus also pointed out that such multiple-resource microgrids require more robust – read more complex and expensive – information and communications systems and platforms, however.

Micro-, Nanogrid Synergy

A synergy exists between micro and nanogrids in remote, off-grid situations, one that parallels that for grid-connected microgrids in industrialized countries making greater use of distributed energy resources, Navigant notes.

¨While competing with each other in certain niche applications, DER generally rise together as commodity costs for key components (solar PV, wind turbines, and advanced batteries) come down while new business models spring up to network and optimize these flexible resources in innovative ways,¨ according to the report’s executive summary.

Navigant has developed its own definition and means of classifying nanogrids. They comprise systems of 5kW or less which in a commercial setting typically meet one primary load, such as a cell tower. Furthermore, from the perspective of technology, preferred use of DC as opposed to AC is perhaps their most distinguishing aspect.

Scaled down microgrids, nanogrids are simpler technologically and more straightforward to deploy, which makes them less risky. That lends nanogrids an advantage when it comes to obtaining financing.

¨A microgrid may serve critical loads in the center of the village (i.e., hospital, school, and community center), whereas nanogrids are developed for villagers that live in homes too far from these larger loads,¨ Navigant explains. ¨In other instances, a nanogrid becomes the preferred path for energy access due to nomadic lifestyles and/or minimal demand for electricity services.

Navigant sees the nanogrid market being much larger than that for microgrids. Total market revenue will reach $8.5 billion in 2015, driven by demand in developing world countries, particularly from mobile telecoms providers.

By 2024, Navigant predicts annual nanogrid market revenue will grow to $17.5 billion. A mix of public and private sector funding to increase energy access will fuel growth.

Combining its growth forecasts for micro and nanogrids on a regional basis, Navigant forecasts a total 1,013.7-MW of capacity will be online come year-end with market revenues totaling $10.9 billion.

Deployments will be greatest in the Asia-Pacific region, where Navigant expects 404.8-MW will be online. That would amount to 40 percent of expected total capacity worldwide. Following is the Middle East-Africa with 327.8-MW expected, 32.3 percent of total global capacity installed.