In ¨The Economics of Battery Energy Storage,¨ RMI lays out 13 distinct services advanced battery storage systems can deliver today. More to the point, the report authors conclude that these systems are economic and cost-effective now.

Like this post? See more from Andrew at GreenWallah.com

Sharp declines in the cost of stationary battery storage have led to a surge in installed capacity in the US. Deployment of stationary battery storage has taken off this year, rising 600 percent on a sequential basis in the second quarter as utilities, commercial and industrial (C&I) businesses, schools, hospitals and public and government offices turn to advanced energy storage solutions as part of strategic efforts to reduce energy costs, ecosystems damage and greenhouse gas (GHG) emissions while enhancing the security and resiliency of power supplies.

The sharp fall in installed system costs has obscured the wide variety of benefits the latest generation of intelligent battery storage systems affords utilities, end-users and society, however, according to clean energy and energy efficiency specialists at the Rocky Mountain Institute (RMI).

In ¨The Economics of Battery Energy Storage,¨ RMI lays out 13 distinct services advanced battery storage systems can deliver today. More to the point, the report authors conclude that these systems are economic and cost-effective now.

13 ¨Un-valued¨ Services Stationary Battery Storage Provides

The cost of stationary lithium-ion (Li-ion) battery systems – far and away the most commonly deployed type of advanced battery storage produced and installed thus far – has dropped from an estimated $1,000 per kilowatt-hour (kWh) in 2007 to $300/kWh today, Snowmass, CO-based RMI highlights in a news release.

Navigant Research has found the market cost of stationary Li-ion batteries has declined anywhere from 40-60 percent in the last 18 months. Industry experts expect costs will fall another 60 percent or more in coming years. That would bring the cost of installing stationary Li-ion battery storage systems all the way down to $120/kWh or less.

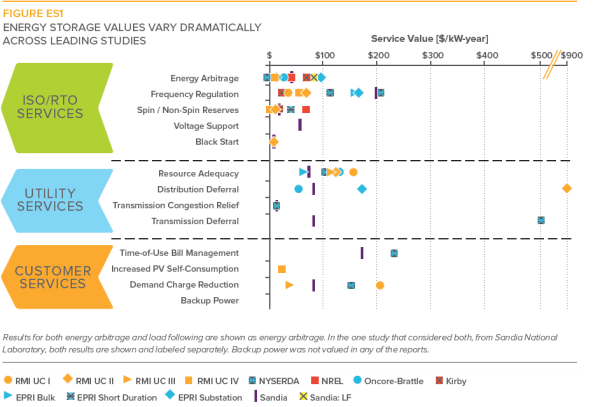

Today’s intelligent battery storage systems provide a wide range of benefits and advantages that are being overlooked as a result of the dramatic drop in cost, however — 13 to be exact, RMI asserts. The narrow focus on cost, RMI stated, ¨crucially misses half the equation: the value batteries can generate for customers and the grid by delivering multiple services.¨

“Most batteries today are deployed for a single, primary purpose, such as demand charge bill reductions for commercial utility customers,” report co-author Jesse Morris, a manager with RMI’s electricity practice, explained. “Delivering that primary service only uses the battery five to 50% of the time. That’s like building a hotel and only selling up to half the rooms. You’re under-utilizing the asset and leaving tremendous potential value on the table.”

Commenting on their conclusions, RMI report co-author and senior associate Garrett Fitzmorris stated: “We found that batteries can deliver up to 13 diverse services … and the closer that you place those batteries to the customer – ideally, behind the meter – the more of those services you’re able to provide.”

“Most incredibly, we discovered that when batteries provide multiple services – rather than a single, primary service – they aren’t cost-effective in the near future, dependent on continued cost declines, as many forecast; they’re economic today.”

State energy market reforms needed to realize full value, unleash market growth

*Credit: RMI

*Credit: RMI

Energy storage specialists who for years have been carrying out fundamental and applied research on the overall costs and benefits of intelligent battery storage technology have been saying just that in industry reports, conferences and private meetings.

Battery storage advocates and proponents have found support among power industry regulators, grid operators and utilities in states such as California, New York and Massachusetts.

This past June, Oregon’s government passed HB2193-B, which, subject to approval of the state public utilities commission, would require Oregon power distribution utilities serving 25,000 or more retail customers to deploy one or more battery storage systems with total capacity not to exceed 1 percent of its 2014 peak load.

Generally speaking, however, a lack of willingness to institute energy market reforms on the part of these critical industry participants is the biggest, most substantial obstacle holding back even faster deployment of stationary battery storage systems, both in front of and behind utility meters at customer sites.

*Credit: RMI

*Credit: RMI

Power market and industry regulations in large part determine the business models that private and public sector market participants develop and base their businesses on. At present, behind-the-meter energy storage assets distributed at utility customer sites only employ between 5 percent and 50 percent of a battery’s useful life, according to RMI’s analysis.

State and federal power industry and market regulators could do much to accelerate uptake of stationary battery storage systems by changing the rules that govern the value utilities and customers could realize by having them installed, RMI says in the report.

In addition to ancillary services, such as demand-charge reduction, end-users could deploy battery storage capacity for primary applications, such as combined solar plus storage systems. Surplus or unused stored energy from these distributed systems could then be made available to utilities and grid operators on as-needed basis.

Furthermore, RMI suggests deploying “multiple, stacked services” that create additional value for all stakeholders to the electricity system.¨ Stacked services, RMI explains, include frequency regulation, resource adequacy, and energy price arbitrage.